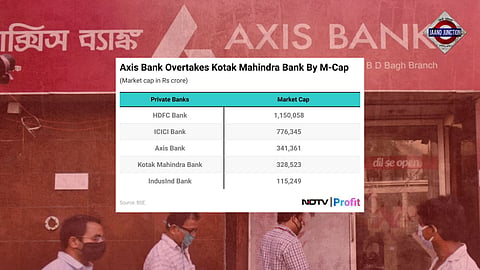

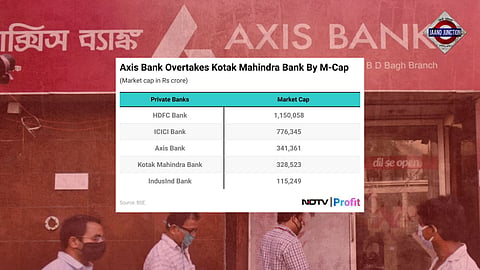

Axis Bank on Thursday surpassed Kotak Mahindra Bank to become the fourth-largest banking stock on Dalal Street.

Axis Bank's shares rose by 4% due to better-than-expected Q4 results, while Kotak's shares dropped by 10% following an RBI ban on digital customer sourcing and new credit card issuance.

As a result, Kotak's market value fell to Rs 3.3 lakh crore, while Axis Bank's rose to Rs 3.4 lakh crore. HDFC Bank remains the most valuable Indian bank, followed by ICICI Bank and SBI.

Kotak and Axis have been rivals for a while. Kotak was leading in market value until recently when investors became concerned about succession issues after the departure of Uday Kotak. This led to a decline in the stock's value.

Recently, the RBI banned Kotak from onboarding new customers online and issuing new credit cards, causing further stock decline.

Analysts worry about Kotak's future if these issues aren't resolved quickly.

Kotak had been seeing growth in retail products, especially through digital channels, but the RBI ban will disrupt this growth and affect profitability, according to Motilal Oswal.

When HDFC Bank faced similar restrictions, it lost market share in credit card spending. Kotak says it's working to improve its IT systems and resolve issues with the RBI.

These restrictions will be reviewed after an external audit, which could take 6-12 months, analysts predict.