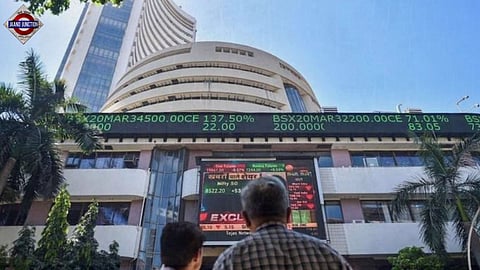

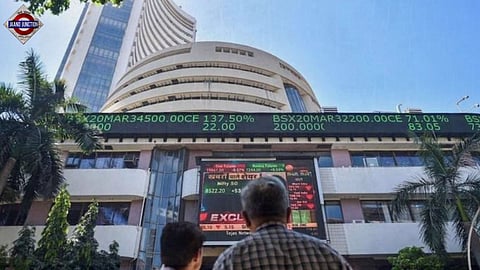

On July 15, the Indian stock market witnessed significant milestones as both the Nifty 50 and the Sensex, its primary indices, achieved new all-time highs. The Nifty 50, which monitors 50 major Indian companies listed on the National Stock Exchange (NSE), reached a peak of 24,635.05 points during the day, closing slightly lower at 24,586.70 points, reflecting a gain of 0.35% from the previous session. Similarly, the Sensex, comprising 30 large-cap stocks on the Bombay Stock Exchange (BSE), peaked at 80,862.54 points and settled at 80,664.86 points by the day's end, marking an increase of 0.18%.

Investor confidence was strengthened by strong performances across the midcap and smallcap segments, with the BSE Midcap index rising by 0.95% and the Smallcap index posting a modest gain of 0.21%. This broad-based positivity underscores the prevailing bullish sentiment in the Indian equity market. Several factors contributed to the upbeat mood among investors. Foremost among these is the anticipation surrounding the upcoming Union Budget. Investors are optimistic that the budget will introduce policies aimed at fostering economic growth and reforms, which could further enhance market sentiment.

Additionally, robust quarterly earnings reports from Indian companies have been reinforcing the positive outlook. Companies across various sectors have reported earnings that exceeded expectations, reflecting resilience and recovery in the post-pandemic economy. Furthermore, increased investments from foreign institutional investors (FIIs) have underscored confidence in India's economic prospects.

During the trading session on July 15, more than 300 stocks on the BSE reached their 52-week highs, including prominent names such as Tech Mahindra, ONGC, and Wipro. This surge in stock prices contributed to an overall increase in the market capitalization of BSE-listed companies, which rose to approximately ₹455.1 lakh crore.

This significant rise of ₹2.7 lakh crore in market value in a single day highlights substantial wealth creation for investors. In terms of individual stock performance within the Nifty 50, the top performers included ONGC, SBI Life, and Shriram Finance, each experiencing notable increases in their share prices. Conversely, stocks such as LTIMindtree, Asian Paints, and Grasim witnessed declines, reflecting mixed performance across sectors. Leading contributors to the Nifty 50's gains were stocks like SBI, ONGC, NTPC, ITC, and Bajaj Auto, while Axis Bank, Asian Paints, TCS, Grasim, and ICICI Bank exerted downward pressure on the index.

Sector-wise, most industry indices closed the day on a positive note, with the exception of the Nifty IT index, which registered a slight decline. Notably, the Nifty PSU Bank index stood out with the strongest performance, surging by 3.07%. Other sectors such as Oil & Gas, Media, Realty, Healthcare, Pharma, and Auto also recorded significant gains, reflecting broad-based buying interest across different segments of the economy. Looking ahead, technical analysts suggest that maintaining key support levels will be crucial for sustaining market momentum. For the Nifty 50, the critical support level is around 24,500 points, while for the Sensex, it is approximately 80,500 points.

Holding above these levels could pave the way for further upward movement, potentially pushing the Nifty 50 towards the 24,650–24,700 range and the Sensex towards the 81,000–81,200 levels. Market observers are closely monitoring global developments, geopolitical tensions, and upcoming decisions by central banks, particularly the Federal Reserve.

These external factors could impact market sentiment and investor behavior in the days leading up to and following the Union Budget announcement. In summary, July 15 marked a significant day for India's stock markets, with record highs achieved by the Nifty 50 and Sensex. The positive sentiment driven by strong domestic fundamentals and external factors underscores the resilience and potential of the Indian equity market amid evolving global dynamics.